How to Take Real Estate Investing to the Next Level

One of the questions I receive a lot from new or experienced investors alike is how to buy properties for passive income (buy & hold) with no money of their own, credit or bank financing.

Real estate financing, especially for investors, is not what it used to be. Banks have put limits on how many properties an investor can buy, and the financial requirements for the investor can be very strict. Statistically today over 80% of real estate investing mortgages applicants are denied.

The important point here is to shift your thinking if you want to succeed as an investor – basically “Think like the Rich” – don’t think how much it is going to cost, but how much it will make. If you shift your thinking this way, you will see opportunities and solutions instead of problems.

So, what are the options if an investor is trying to build a real estate investment portfolio of rental properties? In real estate, when one door closes another one opens. There are several options for real estate investors to accumulate a portfolio of properties without bank financing or hard money.

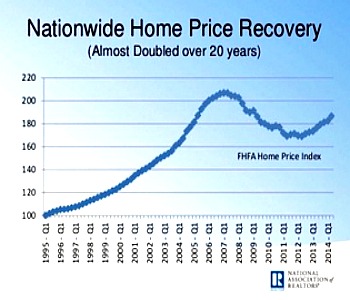

Warren Buffet said recently, “Fortunes are made in a recovery market.” Historically, real estate has been appreciating exponentially, especially after a recession. If you look at this chart from the National Association of Realtors, prices have practically doubled over the last 20 years. By the way, FHFA stands for Federal Housing Finance Agency.

There are 2 main real estate investing strategies: wholesaling and buy and hold. I call wholesaling as a private ATM machine: you can tap into quick cash while learning the real estate business. Buy and hold, on the other end, creates long term wealth, while providing continuous cash flow and recurring passive income and considerable tax advantages. With “buy and hold” you build an investment, without using any of your money: the tenants pay down your liability, build your equity and net worth, while providing income. It is a win-win situation.

There are 3 types of passive income from real estate investing: rental or option income, generating notes and joint venture partnerships. Rental or option income is the most common type of real estate income that the investor receives from owning real estate and renting it out. Generating notes is a clever way to create ‘notes’ or ‘paper’ on real estate that the investor does not even ever own: a typical example, is placing a second mortgage on a property that is flipped on the wholesale market. Joint venture partnerships are created when ‘money partners’ are brought in as investors and charged for their participation in the deal.

Subscribe to our podcast

Subscribe to our podcast