Hard Money Definition

Diving into the real estate investing industry can be confusing, especially if you are new to the business. The first thing you may want to do is apply for a loan to begin purchasing real estate. As you research, the term “hard money” loan may come up. What is hard money? Is this type of loan something you should look into further? Does it apply to your specific needs? Learn everything you need to know about hard money loans and contact a real estate investing mentor if you have any questions about the process of obtaining a loan.

What is a Hard Money Loan?

Unlike traditional loans that are acquired through banks or credit unions, a hard money loan is a short-term loan that is acquired by real estate and are funded by private investors. This type of loan is typically around 12 months, but can be as long as two to five years. Throughout the life of the loan, the payments are interest only, or interest in addition to some of the principal, and then at the end of the loan there is one large final payment.

Even though a real estate investor’s credit score is important to the lender, the loan is typically not given based on credit alone. This makes receiving this type of loan possible when there has been a recent foreclosure that has affected the credit score. With a hard money loan, the lender is primarily interested in the value of the property. An investor can receive a hard money loan for a house that is already owned or they are planning on purchasing. The piece of real estate will be used as collateral.

When to Use a Hard Money Loan

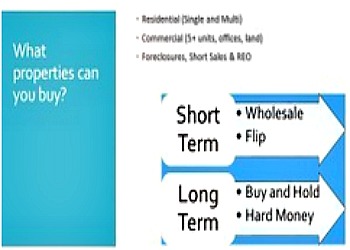

While this type of loan can be used for several types of properties (single-family, commercial, land, etc.), it can depend on the lender’s experience with a specific property type. Lenders often specialize in a certain type of property, so be sure that the lender can work with you.

When a real estate investor has the time, credit score, and income history necessary to obtain a traditional bank loan, that is the ideal route. However, if the situation requires a special kind of loan, a hard money loan can be used when:

- An investor is fixing and flipping a house.

- An investor wants to obtain a loan for a piece of land.

- An investor is looking to obtain a construction loan.

- Bad credit limits a traditional bank loan.

- An investor needs a loan quickly.

Is a Hard Money Loan Right for You?

Applying for a hard money loan comes down to time and credit. If you’re a real estate investor who needs a loan quickly, hard money loans are a good choice. The money can often be provided within a week and the application process can usually be completed with a day or two. Traditional bank loans can take months for the application process and the loan to be completed. If your credit score is less than perfect, this type of loan is a work around.

Know the Risk

There is always risk with any real estate investment prospect, but moreso with hard money loans compared to a traditional bank loan. To offset this risk, the interest rates can range from 10 to 15 percent. The interest rate, or monthly payment, will vary depending on the lender and the region.

The interest rates are also dependant upon the loan to value (of the property) ratio, or LTV. Lenders typically loan 65 to 75 percent of the current value of the property. However, some lenders will loan an amount based on the after repair value, or ARV. This is the estimated value of the home after improvements have been made.

For more information on hard money loans and how the loan and interest rates are determined, contact a real estate investing mentor today.

For more training and information on Hard Money definition and Private Money, check out my webinar: Private Money Made Easy.

Subscribe to our podcast

Subscribe to our podcast